Jake From State Farm is Full of Crap

A Case Study in Insurance Bad Faith: How State Farm and CCC Intelligent Solutions Systematically Undervalued My Vehicle and How You Can Avoid My Woes

When your car is totaled through no fault of your own, you expect the insurance process to be fair, transparent, and data-driven. What I experienced with State Farm and their valuation partner CCC Intelligent Solutions was a masterclass in how insurers can manipulate the claims process to shortchange victims while maintaining plausible deniability.

The Setup: When "Good Neighbor" Becomes Bad Actor

On June 22, 2025, a State Farm-insured driver totaled my car. What should have been a straightforward total loss claim became a battle that revealed how major insurers systematically undervalue vehicles using technically compliant but practically unfair methods.

I’m not a car dealer or licensed appraiser, but I spent over 20 years in residential mortgage lending, where I reviewed thousands of real estate appraisals. While auto and real estate valuation differ, they share core principles: legitimate comparables, condition-based adjustments, and market reflection. I knew what a fair valuation process looked like—and what I received from State Farm wasn't it.

I should have expected this based on my last experience when a State Farm insured driver hit me on my bike and broke my leg. State Farm then put me through weeks and months of fighting to be reimbursed for the medical bills. In the end, a manager finally agreed that my requests were reasonable and they agreed to the settlement. If I was reasonable all along, why did it take so long to solve? I point to this to show a trend and not an outlier which validates deliberate behavior and intent in policy. Back to the horrible experience at hand, however.

The Bait-and-Switch That Changed Everything

After my discussion with the adjuster, the story takes a turn that transforms this from a typical valuation dispute into potential bad faith claims handling. To provide proof of inadquate valuation, State Farm asked me to provide comparable vehicles to help with the valuation.

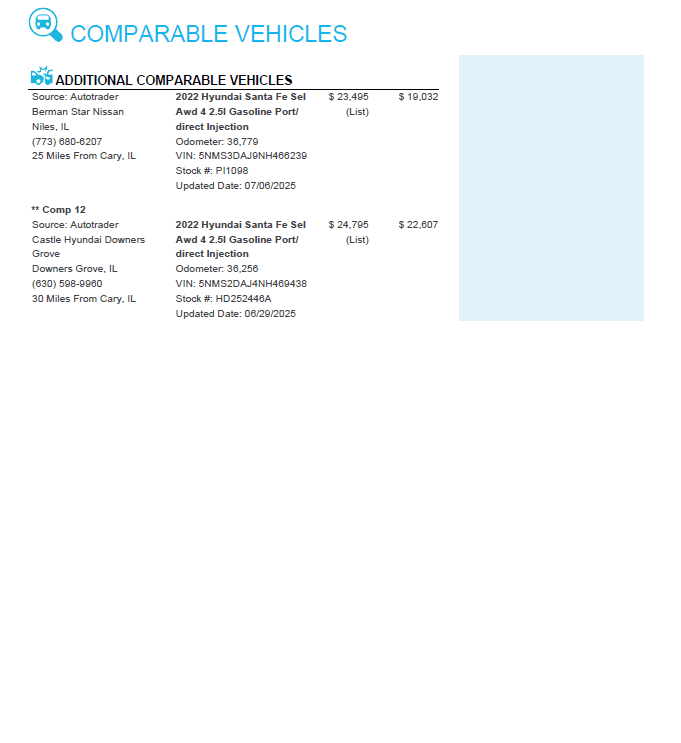

So I did exactly what they requested. I researched the market within a 150-mile radius and provided 10 comparable vehicles with similar mileage and features. These vehicles were priced between $23,497 and $27,998, with an average of $25,738. As expected, there were few to none in the outlier range that they found in the previous report.

Then came the gut punch.

When I received the CCC Market Valuation Report on July 9, 2025, I found this statement buried in the methodology section:

"Because the loss vehicle was recently valued, the comparable vehicle(s) were added for informational purposes and were not used to determine the Base Vehicle Value."

Let that sink in. State Farm requested market research from me—the victim of their insured driver's negligence—then used it for "informational purposes" while basing my settlement on a week-old valuation that ignored all current market data. They wasted my time and did nothing to advocate. Why would they do this if not deliberately working to keep the value down?

My recent discussion with the manager for my claim confirmed that while they submitted my comparables, there was no effort to clarify whether the low values were like vehicles in condition, why the report used the low values over other comparable values that were part of the report and would have provided a higher mean and whether my comparables would be fairly evaluated. Basically, it was pushing paper with no involvement or effort to answer the questions.

This is not advocacy as they like to profess. Instead, it is a simple attempt to take advantage of people when they need to replace a vehicle, which could be essential to their livlihood, so as to force them into accepting a low valuation to just get a means of transportation. This is a huge injustice.

The Three Pillars of Valuation Manipulation

1. The Outdated Valuation Gambit

My July 9 report wasn't actually based on July 9 market data. Instead, CCC pulled a "Base Vehicle Value" from a previous valuation dated July 3, making only a token $50 condition adjustment.

Despite CCC listing twelve current comparable vehicles (more if you include the ten I provided), none of them influenced my settlement. CCC essentially said: "Thanks for the current market research, but we're going with last week's numbers."

In any legitimate valuation methodology, fresher data supersedes older data. Using a stale valuation when better comps exist isn't "market-driven"—it's conveniently self-serving.

2. The Strategic Outlier

Among the comparables listed was Comp 5, adjusted to $18,501—nearly $2,000 below the next lowest comp and $6,000+ below several others. This outlier had:

No condition verification

No inspection notes

No meaningful validation

No explanation for why it was so far below market

Yet its inclusion helped anchor the overall valuation artificially low. Meanwhile, higher-priced, more representative comps were dismissed as "informational."

The figures above show the comps with valuation and condition, but the adjuster and his manager were unable to verify that there was any review of accuracy for how the comparables were valued or rated for condition. It was whatever they were given. Most were no longer available for my review or for me to question the veracity of what they assigned.

If you've ever reviewed appraisals, you know the rule: you don't include a distressed property unless you explain it and justify its impact. This was an unverified outlier, included without scrutiny, used to create a misleading price environment.

3. The Condition Assessment Shell Game

Despite my vehicle being in above average mechanical and very good interior condition—clean, protected with premium mats, well-maintained—CCC's report rated it as merely "Good" across all categories. More tellingly, the report showed zero inspection notes, despite stating:

"Inspection Notes reflect observations from the appraiser regarding the loss vehicle's condition."

When I questioned this, the State Farm adjuster revealed the system’s true nature:

"Good is the default unless you provide detailed photos of every component to prove otherwise."

He add that he would “see what he could do” about the condition as if it was a favor to do so instead of fulfilling a mandate for accuracy and fairness. Again, a State Farm driver wrecked my car and put me in a situation of having no transportation and it is supposed to be some type of favor to make sure that I am getting a fair and equitable value for my vehicle.

Think about that. I was the victim of their insured driver's negligence, and they placed the burden on me to produce pre-loss photos of every element of my car's interior, exterior, and mechanical condition. As if the average person maintains a running photo inventory of their headliner, seat bolsters, dashboard panels, and floor mats—just in case someone totals their vehicle.

When I pushed back and requested a re-evaluation, the tone shifted ominously:

I was warned that revisiting the value might delay my claim and could even lower the offer.

The message was clear: Take what we're offering, or risk losing more.

As the conversation continued, I was told:

"I'm trying to help you, but you're being unreasonable."

And when I asked for a supervisor:

"She'll just tell you the same thing."

I tried to keep the conversation constructive. I agreed to concede the exterior rating (except for the clean windshield and glass), but emphasized that the interior clearly warranted review.

When I finally reached a supervisor, she validated that the condition assessment should be reviewed again. That moment confirmed four things:

The original assessment was inadequate

The adjuster's "default condition" policy was indefensible

The system relies on people giving up before someone higher up has to get involved.

They acknowledged that they as process should be reviewing condition of my vehicle for accuracy.

4. Why CCC’s Flat Condition Adjustment Makes No Sense

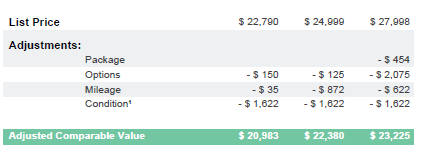

Since it seemed that everyone at State Farm adheres to the CCC report as if it were etched into two tablets on Mt. Sinai, I looked further at the report. As I examined the CCC valuation more closely, one detail stood out: every comp had a fixed deduction of -$1,622 for "Condition Adjustment.”

That figure was applied universally, regardless of the price of the vehicle.

This flat-dollar deduction makes no logical or mathematical sense. Here’s why:

Vehicle prices vary—so should the deduction.

A $20,000 comp loses 8.1% of its value from that deduction.

A $28,000 comp loses only 5.8%.

CCC is applying a disproportionate penalty depending on the base price and State Farm accepts it because it was in their favor. It is painfully evident to even the casual observer that condition should be a percentage-based adjustment or at least done in a way that provides consistency on price and value.

In appraisal industries, condition is always relative to value. High-value vehicles incur higher absolute deductions when condition is poor — and vice versa. This report shows at the very least lazy modeling and, at the worst, another method of intentionally supressing accident victim’s reimbursements. It’s a shortcut that suppresses claim values while appearing standardized.

In short, CCC’s flat $1,622 condition deduction makes no logical sense when applied across comps with varying prices. In a legitimate valuation model, condition is assessed as a percentage of vehicle value—not a static penalty. Using a single dollar figure unfairly exaggerates the deduction on lower-value comps and underrepresents it on higher ones. It’s a one-size-fits-all tool in a situation that demands nuance.”

The Financial Reality: A $3,000–$5,000 Shortfall

This wasn’t just about principle—it was financially punishing. According to State Farm’s CCC-based offer, I would be left $3,000–$5,000 out-of-pocket to replace my vehicle with one of similar year, mileage, and features.

That’s a 15–20% shortfall — after their insured driver wrecked my car.

Fight, Don’t Fold

It is high time that the little guys and gals stop accepting these practices from corrupt corporate actors. When this happens to you, do not roll over. Be empowered.

For example, I’ve filed formal complaints with the Departments of Insurance in both Illinois, where I live, and Wisconsin, where the accident occurrerd.

The core issues I raised include:

Process Misrepresentation: Requesting market research under false pretenses

Selective Data Usage: Ignoring current market data in favor of outdated valuations

Inadequate Investigation: Failing to properly assess vehicle condition

Burden Shifting: Requiring victims to disprove default assumptions

These aren’t just bad practices — they may constitute violations of state insurance regulations regarding fair claims handling. Either way, we should each one of us strive to make the lives of the people who allow this to occur or even create these practices as painful as possible. In the same way that they create work for us as the victims, we should punish their bottom line by flodding the zone on any claims that are not reflective of fairness. Who knows, maybe a class action may reward you some day.

The Bigger Picture: Systemic Undervaluation

This case illustrates how insurers can systematically undervalue claims through technically compliant but practically unfair methodologies. The key elements of this system include:

Information Manipulation: Collecting better data while predetermined to ignore it

Process Theater: Creating the appearance of thoroughness while cutting corners

Victim Intimidation: Warning that challenging valuations might lead to worse outcomes

Regulatory Arbitrage: Using complex methodologies that are hard to challenge

What You Can Do

If you're facing a similar situation, here’s what I’ve learned:

Document Everything: Keep records of all communications

Research Independently: Don’t rely solely on insurer-provided valuations

Understand the Process: Learn how your insurer’s valuation methodology works

Challenge Assumptions: Question default ratings and demand supporting evidence

Know Your Rights: Understand your state’s insurance regulations and complaint processes

The Path Forward

State Farm says they’re a good neighbor. In my case, they wouldn’t even open the door.

This isn’t just about my settlement — it’s about transparency in an industry that affects millions annually. When insurers can ask for market research and then ignore it, use outdated data over fresh comps, and shift the burden of proof to victims — the system is broken.

Insurance is supposed to make you whole after a loss. Instead, I discovered a system designed to protect insurers — at the expense of the people who need help most.

If you’ve had a similar experience, I want to hear from you. It’s time we shine light on these practices and hold them accountable.

The documentation speaks for itself. The question is: what are we going to do about it?

HOW TO FIGHT

If you find yourself in a situation like mine, you are not helpless. In fact, you are more empowered than ever to stand your ground. AI is a powerful tool in making companies like State Farm explain their valuation and to fight the likely under-valuation.

Here is a how to:

Prompt to Use with ChatGPT: Insurance Valuation Rebuttal Builder

I was recently involved in an auto accident, and I believe the insurer’s total loss valuation (from CCC, Mitchell, or another provider) may be unfair or inaccurate. I want help analyzing the valuation report and building a strong, well-supported rebuttal. I will upload:

The insurer’s valuation report (PDF)

Photos or documentation of my vehicle’s condition, if available

My notes or comps (optional)

What I want from you:

Identify any outliers or comps that skew the value unfairly.

Highlight unverified or poorly documented condition assumptions.

Evaluate whether the adjustments made (for mileage, condition, options) are reasonable.

Generate a fact-based rebuttal letter that I can submit to my insurer or state insurance department.

If helpful, create a visual summary or talking points I can use in follow-up conversations.

Instructions for Use:

Be sure to include the claim number and report date in your file names.

If you don’t have documentation, just describe the vehicle’s condition clearly.

Mention whether you were the policyholder or a third party (e.g., hit by an insured driver).

Share this with ANYONE you know. Every rebuttal costs THEM money. Every rebuttal wastes THEIR time. Every rebuttal gets logged in their system and can later be used to ilustrate any patterns that exist in their practices for later validation if per chance they had to defend them to regulators or legal action. We have the power.